August Market Update: PSEi Rebalancing, Jackson Hole, and BSP Rate Cut

- Justin Choi, Hans Elma, Dennis Go, Jared Go

- Sep 27, 2025

- 8 min read

Authored and Edited by: Justin Choi, Hans Elma, Dennis Go, Jared Go

Latest Economic Data

Philippine Economic Data

YoY GDP Growth (2nd Quarter): 5.5%

YoY CPI (August)

Headline: 1.5%

Core: 2.7%

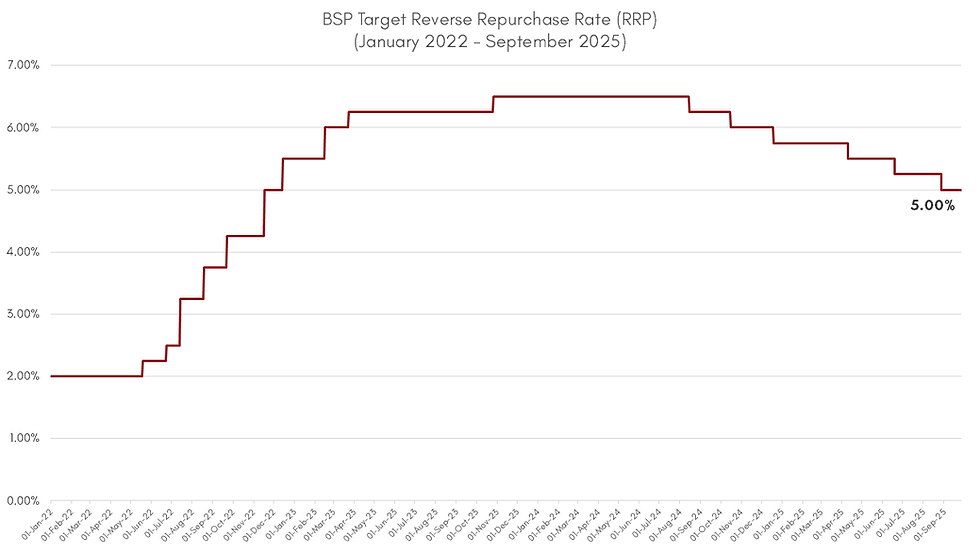

BSP Reverse Repurchase Rate: 5.0%

US Economic Data

YoY PCE (August)

Headline: 2.74%

Core: 2.91%

Unemployment Rate: 4.3%

The month of August 2025 was filled with market-moving developments across both global and local fronts. Internationally, the Jackson Hole Economic Symposium called for a more dovish policy stance and shift towards a flexible inflation targeting in the face of a weakening labor market. Locally, Philippines Q2 GDP grew 5.5% with BSP cutting rates for a third straight time to support economic growth. Meanwhile, the PSEi replaced Bloomberry Resorts (BLOOM) to welcome DigiPlus Interactive Corp. (PLUS).

PSEI Rebalancing

Last August 8, 2025, the Philippine Stock Exchange (PSE) announced an index rebalancing of the PSEi which saw the inclusion of DigiPlus Interactive Corp. (PLUS) and the exclusion of Bloomberry Resorts Corp. (BLOOM) effective last August 18, 2025 (PSE, 2025).

Index | Companies Added | Companies Removed |

PSEi | PLUS | BLOOM |

PSE Dividend Yield | KEEPR and PGOLD | FCG, and URC |

PSE MidCap | AUB, BLOOM, and OGP | GMA7, PCOR, and PLUS |

Financials | NRCP | |

Industrial | CIC, CREC, and VITA | BSC, EEI, and MAXS |

Holding Firms | ATN | |

Property | ||

Services | LOTO | |

Mining & Oil | LC and OGP | BC |

Figure 2. Summary of Changes in the PSE Indices’ Composition (PSE, 2025)

The PSEi is the PSE’s primary market capitalization-weighted index, comprising the exchange’s 30 largest and most actively traded common stocks. Its performance closely correlates with the total performance of the PSE, serving as a cost-effective solution for investors to expose themselves to the Philippine market. To be included in the index, public firms must meet stringent regulatory requirements, such as minimum public ownership, median daily trade value, and market capitalization. Investors widely anticipated PLUS’ inclusion into the PSEi, despite intense speculation and volatility over regulatory risks in the country’s online gaming industry.

Last August 14, 2025, the Bangko Sentral ng Pilipinas (BSP), through Memorandum No. M-2025-029, directed all supervised institutions, including banks, e-wallets, and payment apps, to remove, within 48 hours, any in-app links or redirects that provide access to online gambling sites on their mobile applications and websites (BSP, 2025b). As a result, the Philippine Amusement and Gaming Corporation (PAGCOR) reported that online gaming transactions dropped by as much as 50% following the BSP directive, demonstrating the regulatory sensitivity and fragility of the sector (Subingsubing, 2025). The sudden decline underscored how quickly financial regulators can affect liquidity flows in digital gambling platforms, raising concerns about the long-term viability of online gaming as a reliable revenue stream.

Jackson Hole

"With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance." - Jerome Powell

At the Jackson Hole Economic Symposium on August 21, 2025, U.S. Federal Reserve Chair Jerome Powell signaled a more dovish policy stance (Powell, 2025). This change is in response to the present weak labor market conditions amidst the economy’s high inflation environment.

US Inflation and Unemployment

As of August 2025, headline inflation remains higher than the FED’s 2% target, with the Consumer Price Index (CPI) rising to 2.94% YoY, in contrast to July’s 2.73% (BLS, 2025). Core inflation, which excludes volatile food and energy prices, edged higher at 3.11% YoY.

Personal Consumption Expenditures (PCE), the preferred inflation indicator of the Federal Reserve, also saw its headline rate rising to 2.74% YoY in contrast to July’s 2.6%. Core PCE also went up YoY to 2.91% from 2.85% last July (BEA, 2025), further underscoring that current inflation is not a result of temporary supply shocks but underlying pressures like tariffs, adverse wage-price dynamics and high inflation expectations (Powell, 2025).

At the same time, the labor market has shown signs of fatigue: the rate of unemployment has increased to 4.3%, the highest since four years ago (BLS, 2025). Additionally, the initial job estimations by the Bureau of Labor Statistics went down by 911,000 job positions for the 12 months through March 2025 (Mutikani, 2025), along with only 22,000 non-farm payrolls were added where estimates initially stated 77,000 (BLS, 2025). These reveal that earlier reports of employment strength were overstated.

This combination of a high rate of inflation and weakening employment places the FED in a bind. To navigate this tension, the FED introduced a more dynamic approach, shifting from its Flexible Average Inflation Targeting (FAIT) framework to a Flexible Inflation Targeting (FIT) strategy.

Flexible Inflation Targeting (FIT)

"Our revised statement emphasizes our commitment to act forcefully to ensure that longer-term inflation expectations remain well anchored, to the benefit of both sides of our dual mandate." - Jerome Powell

The Federal Reserve reviews its monetary policy strategy every five years. The last review, in August 2020, adopted the FAIT (Flexible Average Inflation Targeting) strategy. This policy allowed inflation to run moderately above the 2% target following periods of sustained low inflation. The goal was to offset low growth and inflation, which had been a persistent issue for decades, even when policy rates were on the effective lower bound (ELB) (Powell, 2025).

However, in response to post-pandemic inflationary shocks, the Fed reviewed and revised its strategy. It re-emphasized its commitment to well-anchored inflation expectations and vowed to “act forcefully” to achieve its dual mandate of price stability and maximum employment. The Fed also committed to a “balanced” approach, noting it may take preemptive action to address risks to either goal. The 2% inflation target remains unchanged (Powell, 2025).

Impact of Jackson Hole

At the time of the Jackson Hole speech, U.S. 10-Year treasury yields, one of the general proxies for a risk-free interest rate, slid more than 7.5 basis points to 4.256%, signaling bond investor confidence in the Federal Reserve’s approach moving forward.

Equity investors also signaled confidence, as the S&P 500 rose by 1.52%, with its largest constituents–Nvidia, Meta, Alphabet, Amazon, and Tesla–rising by 1.7%, 2%, 3%, and 6% respectively after the announcement.

Looking ahead, markets are already placing the likelihood of a rate cut, with falling U.S. 10-Year Treasury yields and a strong S&P 500 rally, as mentioned above, reflecting growing confidence in a dovish shift. The Federal Reserve already cut its target policy rate by 25 bps in its September 17th meeting (Federal Open Market Committee, 2025), while CME FedWatch estimates a 87.7% chance that a 25 basis point rate cut will happen on its October 29th meeting (CME Group, 2025). Non-farm payrolls remain a key signal of whether labor market weakness will push the Fed toward policy easing. The announcement of FIT strategy marks a balanced approach of monetary policy outlook, aiming to stabilize price while maximizing employment.

Philippine Macroeconomic Updates

GDP

The PSA reported a 5.5% YoY GDP growth for the 2nd quarter of the year. This is the fastest GDP growth posted by the country since the 3rd quarter of 2024 (PSA, 2025b). All major economic sectors also posted YoY growth for the quarter. Agriculture, Forestry, and Fishing (AFF) grew by 7% YoY, faster than the 2.2% posted in the previous quarter and a complete reverse of the -2.2% YoY decline in 2Q24 (PSA, 2025b). The industry sector posted a modest 2.1% YoY growth, slower than the 4.6% recorded in the previous quarter and the 7.9% recorded in 2Q24. Services posted a 6.9% YoY growth for the quarter, maintaining its growth rate recorded in the same period last year (PSA, 2025b).

Household spending also grew by 5.5% YoY, better than the 4.8% posted the previous year. The top 5 contributors to household spending were (1) Food and non-alcoholic beverages, (2) Transport, (3) Miscellaneous goods and services, (4) Education, and (5) Restaurants and hotels (PSA, 2025b). Demand for these items grew by 5.7%, 11.2%, 4.3%, 9.7%, and 7.4%, respectively. It is interesting to note that only Alcoholic beverages and tobacco posted a decline for this period, at -1.5%. Government consumption also slowed down, posting an 8.7% YoY growth, lower than the 18.7% growth posted in the previous quarter and the 11.9% growth in 2Q24 (PSA, 2025b).

Inflation

Headline CPI re-accelerated to 1.5% YoY from the 0.9% posted in July, bringing YTD inflation to 1.7% (PSA, 2025a). This is within the BSP’s target range of 1.0% to 1.8% (BSP, 2025a). The uptick was led by food & non-alcoholic beverages growing by 0.9% and a slight drop in transport at -0.3%. Main contributors to the uptrend in food inflation were fish, fruits, and vegetables. According to the BSP, the higher costs of fruits, vegetables, and fish were mainly due to unfavorable weather conditions during the month (BSP, 2025a). Prices for rice also continued to fall, contracting by -17%, faster than the -15.9% recorded in July (PSA, 2025a). The drop in rice prices can mainly be attributed to rice tariffs being reduced to 15% from 35% (Cigaral, 2025). Core inflation also increased to 2.7% from the 2.3% posted in July (PSA, 2025a), confirming a gentle acceleration in all items' ex food and energy.

BSP Monetary Policy

On August 28, the BSP cut its key policy rate (RRP) by 25 bps for the 3rd straight meeting (BSP, 2025c), in line with market expectations. This brings the target RRP rate to 5.0% from 5.25%. This is also the lowest level rates have been since the hiking cycle started back in November 2022. BSP Gov. Remolona mentioned that the current policy rate level is a “sweet spot for both inflation and output” (Chan, 2025). The BSP also adjusted interest rates on overnight deposit and lending facilities to 4.5% and 5.5%, respectively (BSP, 2025c). Outlook for inflation remained unchanged for the BSP with key inflationary pressures coming from possible electricity rate adjustments and higher rice tariffs. As for the impact of US trade policies, the BSP continues to monitor the situation of how the changing environment may affect the outlook for the Philippine economy. The BSP maintains its responsibility to safeguard price stability by ensuring monetary policy settings are conducive to sustainable economic growth and employment (BSP, 2025c).

Future Outlook

Markets ended August with a more dovish global backdrop as the Fed pivoted towards a more flexible stance on rate cuts amid softer US labor data. Locally, the Philippines posted a 5.5% Q2 GDP and the BSP delivered a 3rd straight 25 bps rate cut to 5.0%, reinforcing support for growth. Equities saw a notable index rebalancing, with PLUS in and BLOOM out. However, regulatory actions taken against online gambling flows highlighted risks on the industry’s attractiveness. Key items to watch coming into September are US jobs data and CPI for the pace of Fed easing; and PH CPI and BSP guidance on the runway for further cuts for the rest of the year.

References

BEA. (2025, September 26). Personal Income and Outlays, August 2025. U.S. Bureau of Economic Analysis (BEA). https://www.bea.gov/news/2025/personal-income-and-outlays-august-2025

BLS. (2025, September 11). Consumer Price Index - August 2025. U.S Department of Labor. https://www.bls.gov/news.release/pdf/cpi.pdf

BLS. (2025, September 5). The Employment Situation - August 2025. U.S Department of Labor Statistics. https://www.bls.gov/news.release/pdf/empsit.pdf

BSP. (2025a). August inflation rises to 1.5 percent. Bsp.gov.ph. https://www.bsp.gov.ph/SitePages/MediaAndResearch/MediaDisp.aspx?ItemId=7659&MType=MediaReleases

BSP. (2025b, August 14). BSP suspends in-app gambling access in mobile payment apps and websites. Bsp.gov.ph. https://www.bsp.gov.ph/SitePages/MediaAndResearch/MediaDisp.aspx?ItemId=7623&MType=MediaReleases

BSP. (2025c). Monetary board reduces target RRP rate by 25 basis points. Bsp.gov.ph. https://www.bsp.gov.ph/SitePages/MediaAndResearch/MediaDisp.aspx?ItemId=7644&MType=MediaReleases

Chan, K. (2025, August 28). BSP cuts rates for 3rd straight meeting. BusinessWorld Online. https://www.bworldonline.com/top-stories/2025/08/29/694539/bsp-cuts-rates-for-3rd-straight-meeting/

Cigaral, I. (2025, August). Recto: No plans to raise rice tariffs. INQUIRER.net. https://business.inquirer.net/540532/recto-no-plans-to-raise-rice-tariffs

CME Group. (2025, May 13). FedWatch. CME Group. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Federal Open Market Committee. (2025, September 17). Federal Reserve issues FOMC statement. Retrieved September 27, 2025, from https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.htm

Mutikani, L. (2025, September 5). US unemployment rate near 4-year high as labor market hits stall speed. Reuters. https://www.reuters.com/business/us-unemployment-rate-near-4-year-high-labor-market-hits-stall-speed-2025-09-05/

Powell, J. H. (2025, August 22). Monetary policy and the Fed’s framework review. Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy, Kansas City, Wyoming, United States of America. https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

PSA. (2025a). Consumer price index and inflation rate. Psa.gov.ph. https://psa.gov.ph/price-indices/cpi-ir

PSA. (2025b). GDP expands by 5.5 percent in the second quarter of 2025. Psa.gov.ph. https://psa.gov.ph/content/gdp-expands-55-percent-second-quarter-2025

PSE. (2025, August 8). PLUS joins PSEi, replaces BLOOM. PSE. https://www.pse.com.ph/plus-joins-psei-replaces-bloom

Subingsubing, K. (2025, August 20). Pagcor: Online gaming transactions down 50% after BSP directive. Inquirer. https://business.inquirer.net/542185/pagcor-online-gaming-transactions-down-50-after-bsp-directive

U.S. Department of the Treasury. (n.d.). Daily Treasury Par Yield Curve Rates. Retrieved September 27, 2025, from https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2025

Comments