How They Built Their Dream: A Company Spotlight of BYD

- Macky de Guzman, Sistine Luna, Bettina Rey

- Aug 20, 2025

- 8 min read

Updated: Sep 7, 2025

Authored by: Macky De Guzman, Sistine Luna, Bettina Rey

Edited by: Elijah Soriano, Ethan So, Justin Choi, and Jared Go

What is BYD?

In 2024, BYD Cars Philippines experienced an impressive 8900% growth in passenger car sales according to a report by ACMobility, BYD’s distributor in the Philippines (Tabile, 2025). But how did a car manufacturer that was mostly unknown among Filipinos 5 years ago become a household name, and one of the largest electric vehicle (EV) brands not just in the Philippines, but in the whole world?

BYD–an acronym for “Build Your Dreams”–is a Chinese company founded in 1995 by Wang Chuanfu. It began as an advanced battery manufacturer for several brands such as Apple, Samsung, Motorola, and more. The company then decided to enter the automotive industry in 2003, and in 2011, introduced their first ever electric vehicle, the BYD e6 (BYD, 2020). While the manufacturing of batteries and electric components is still a core part of their business (FactSet), BYD’s 2023 annual report shows that automobiles contribute to 80% of their revenues. Now, it is one of the most competitive electric vehicle brands in the market, with sales that rival even that of Tesla (Rivero, 2024; Carter, 2024).

Disruptive Innovation: A Strategy For Market Domination

BYD established itself by following a disruptive innovation model, introducing new solutions that differed from traditional vehicles—often at competitive prices for underserved customer segments (Indiran et al., 2023). For the company, this was achieved through the adoption of electric vehicles (EVs) in both the commercial and passenger-car markets. They introduced the idea of a zero-emission energy ecosystem that is self-sustaining and fully integrated, ensuring clean energy from generation to storage and final use, which they call their “Three Green Dreams” (Masiero et al., 2016). Thus, as part of its broader expansion strategy, BYD introduced its "7+4 Strategy," also known as the Green Mobility Strategy, which aims to electrify all forms of transportation from urban transit, private cars, buses, and even vehicles for industrial use.

The strategic partnerships and stakeholder investments were the key factors that helped BYD grow quickly as an automotive leader. In 2008, Warren Buffet acquired a 10% stake in BYD which allowed it to secure its capital and credibility as a brand. That same year, BYD launched China’s first mass-produced plug-in hybrid, the BYD F3DM. It was then followed by the BYD e6, one of China’s first long-range electric taxis. At the same time, the Chinese government actively promoted EV adoption through incentives and state support (Cheng & Kharpal, 2024). BYD not only saw the demand but also recognized the opportunity for expansion by being the first to start operating in the largest consumer markets. As a result, these early steps were crucial in driving BYD’s EV value proposition and accelerating its entry into global markets.

However, BYD needed to differentiate itself to stay ahead in the competitive passenger car market. Unlike other companies that rely on external suppliers for many vehicle components, their strategy involved vertically integrating its supply chain, producing batteries, semiconductors, chips, and key EV components in-house. Doing this allows them to build vehicles at lower costs while also being able to maximize profits (Lee, 2024). This is a prime example of the vertical integration essential to their business model, which greatly contributes to BYD’s success. Put simply, vertical integration is a business strategy wherein the company owns various stages of the production process for its goods, allowing it to eliminate the costs that come from relying on outside suppliers (Messina, 2022). This vertical integration does not just apply to batteries; a UBS report found that around 75% of the components in a BYD Seal 3 were made in-house, while a Tesla Model 3 only had around 46% of its components made in-house (Zhou, 2023).

What cemented their expertise in the EV industry can also be attributed to their strategic move in 2022 to stop gasoline car production, making them the first major automaker to focus solely on EVs and plug-in hybrids (Xu & Shirouzu, 2022). This shift allowed them to target eco-conscious consumers, businesses transitioning to electric fleets, and government agencies while also enhancing the customer experience through tailored solutions, long-term support, and a strong distribution network (Indiran et al., 2023). Currently, BYD has aggressively expanded its global market presence beyond just factory production. They continued to partner with public transport operators worldwide, supplying electric buses and taxis, while also launching affordable passenger EVs in Europe, Latin America, and Southeast Asia (Masiero et al., 2016; Indiran et al., 2023). All of these things contributed for BYD to emerge to become a powerhouse in the EV market, having successfully introduced electric vehicles to mainstream consumers—not just in China but globally.

How BYD Stands Out

Due to their background as a battery supplier, expanding into the automobile and EV industry allowed them to use this knowledge in manufacturing technology for their vehicles. One of their biggest breakthroughs was the Blade Battery Technology, which was safer, cheaper, and longer-lasting than traditional lithium-ion batteries (Masiero et al., 2016; BYD, 2024). Not only was it adopted by Tesla and other automakers, but it also reduced BYD’s production costs, making production up to 50% cheaper than some European competitors (Bleakley, 2023; Mundy, 2025). Thus, BYD successfully delivered high-quality EVs at affordable prices, making it a more appealing choice for buyers over other brands.

As a case example of how BYD sets itself apart, we compare BYD’s Sealion 6 DM-i, a mid-size crossover SUV, with two comparable hybrid electric vehicles, specifically the Toyota Corolla Cross Hybrid and the Hyundai Tucson Hybrid. The table compares them in terms of the vehicles’ (1) fuel efficiency, (2) combined driving range, and its (3) prices.

Specifications | BYD Sealion 6 DM-i | Toyota Corolla Cross | Hyundai Tucson |

Fuel Efficiency | 16.67 km/L | 23.3 km/L | 16.15 km/L |

Driving Range | 1,092 km | 716 km | 676 km |

Price | ₱1,548,000 | ₱1,514,000 | ₱2,290,000 |

Figure 1. Comparison between the BYD Sealion 6 DM-i, Toyota Corolla Cross, and Hyundai Tucson (Sources: BYD, BYD Cars Philippines, Toyota PH, Toyota Newsroom, Green Toyota, Toyota Malaysia, Hyundai PH, Hyundai USA)

In terms of fuel efficiency, the BYD Sealion and Hyundai Tucson have a similar fuel efficiency at around 16 km/L, while the Toyota Corolla Cross stands apart at 23 km/L. However, how the BYD Sealion truly differentiates itself is its combined driving range of 1,092 km in comparison to the Toyota Corolla Cross and the Hyundai Tucson which can only run for 716 km and 676 km respectively. Thus, combined with a value-for-money price of ₱1,548,000, the BYD Sealion’s exceptional driving range makes it a strong contender in the hybrid EV market.

Dream-Like Financials

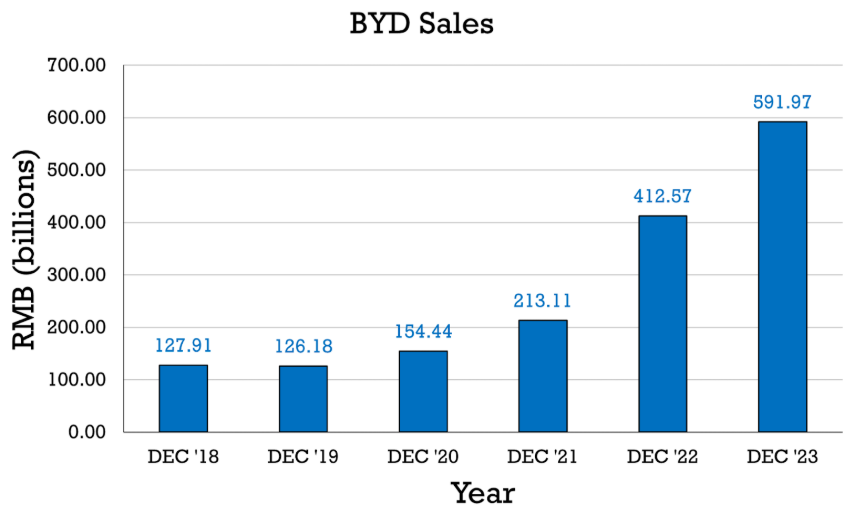

BYD’s financials reflect the boons of their unique business model, with Figure 2 below illustrating the company's revenue growth from 2018 to 2023, during which sales increased by a staggering 362.8%. BYD’s annual reports attribute the 2022–2023 sales surge to its automobile business, highlighting fast-growing overseas sales, which have doubled their revenue share since 2018. However, it must be noted that the majority of their revenue still comes from China. BYD's net income has also grown in proportion to its revenue, as reflected in its rising net margin from 2.17% in 2018 to 5.08% in 2023 (FactSet), an ideal situation for any company regardless of industry.

BYD’s liquidity meanwhile paints a more mixed picture. While its current ratio has maintained a positive value since 2018, it has unfortunately lowered in recent years as seen in Figure 3. Even though BYD’s current liabilities have begun to outsize its current assets, its free cash flows have also increased in this same timespan as seen in Figure 4. This can help to pay their debt obligations in the future.

Moving Forward

BYD has been establishing its dominance in the automotive market with its electric vehicles. The company has seen a significant surge in sales, matching or even surpassing well-known brands and expanding its presence in various countries, including in the Philippines. Despite intense competition, BYD’s disruptive innovation model, driven by a vertically integrated strategy, continues to strengthen its market value and solidify its position in the industry. Moreover, BYD sets itself apart with its advanced Blade Battery Technology, while continuing to better their design and quality in vehicles. However, BYD still faces threats from competitors and challenges in specialization, while certain financial metrics also indicate potential liquidity issues.

Despite this, it has a very positive financial situation overall, characterized by net income growth that has grown in proportion to sales growth, showcasing the strength of their business model. This underscores BYD’s strength in innovation and electric vehicles, solidifying its position as a giant of the EV industry. As global demand for EVs rises, major automakers are also introducing their own models to compete, raising concerns especially given recent trade tensions between China and other key automotive regions. The key challenge for BYD lies in how it will continue to sustain and strengthen its market value, to ensure its dominance in the evolving EV landscape.

(Disclaimer: This article was written prior to the release of BYD's 2025 Interim Report. Consequently, the analysis and conclusions presented here do not reflect any new financial data, strategic announcements, or other information that may have been disclosed in that report. For the most current and accurate information, readers should refer directly to BYD's official 2025 Interim Report.)

References

Bleakley, D. (2023, May 22). Tesla’s switch to BYD batteries is achieving faster charging times. The Driven. https://thedriven.io/2023/05/22/teslas-switch-to-byd-batteries-is-achieving-faster-charging-times/

BYD Cars Philippines (n.d.-a). About Us: BYD Cars Philippines. https://bydcarsphilippines.com/about

BYD Cars Philippines (n.d.-b). BYD Sealion 6 DM-i. https://bydcarsphilippines.com/vehicles/byd-sealion-6-dm-i

BYD Europe (n.d.) BYD SEAL U DM-i: An All-New Plug-In Hybrid SUV. https://www.byd.com/eu/hybrid-cars/seal-u-dm-i

Carter, T. (2025, February 20). BYD and its rivals are crushing Tesla in China — and going global. Business Insider. https://www.businessinsider.com/byd-xpeng-china-ev-crushing-tesla-going-global-2025-2Kharpa

Cheng, E., & Kharpal, A. (2024, January 4). Musk once laughed off BYD as a threat. now the Chinese giant has taken Tesla’s EV crown - here’s how. CNBC. https://www.cnbc.com/2024/01/05/how-byd-grew-from-a-phone-battery-maker-to-ev-giant-taking-on-tesla.html

Gao, Y. (2021). Analysis of byd’s business model and future development prospects: 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021), Guangzhou, China. https://doi.org/10.2991/assehr.k.211209.067

Green Toyota (n.d.). 2024 Toyota Corolla Cross Fuel Economy. https://www.greentoyota.com/research/new-toyota-corolla-cross-mpg.htm

Hyundai Philippines (n.d.) Price List - Hyundai Motor Philippines. https://www.hyundai.com/ph/en/build-a-car/price-list

Hyundai USA (n.d.) Hybrid Vehicles | Hybrid Model Lineup. https://www.hyundaiusa.com/us/en/electrified/hybrids

Indiran, L., Lei, J., Baskaran, S., Yaacob, T. Z., Abdul Kohar, U. H., & Amat Senin, A. (2023). Disruptive innovation: A case study of byd’s business model canvas. International Journal of Academic Research in Business and Social Sciences, 13(9), Pages 861-875. https://doi.org/10.6007/IJARBSS/v13-i9/17822

Lee, D. (2024, January 5). How China’s BYD Beat Tesla at Its Own Game. Bloomberg. https://www.bloomberg.com/news/articles/2024-01-04/how-china-s-byd-beat-tesla-at-its-own-game-to-become-king-of-the-evs

Li, Q., Yan, Z., & Goh, B. (2025, February 10). China’s BYD cuts entry price for smart EVs to below $10,000. Reuters. https://www.reuters.com/business/autos-transportation/chinas-byd-sell-21-models-with-its-gods-eye-smart-driving-tech-2025-02-10/

Masiero, G., Ogasavara, M. H., Jussani, A. C., & Risso, M. L. (2016). Electric vehicles in China: BYD strategies and government subsidies. RAI Revista de Administração e Inovação, 13(1), 3–11. https://doi.org/10.1016/j.rai.2016.01.001

Messina, M. (2024, August 13). Council post: Exploring vertical integration in the supply chain. Forbes. https://www.forbes.com/councils/forbestechcouncil/2022/12/29/exploring-vertical-integration-in-the-supply-chain/

Mundy, S. (2025, January 6). Tesla, BYD, and a two-speed global transition. Financial Times. https://www.ft.com/content/517a09d8-386e-4ac2-9eae-bd4e85405094

Rivero, N. (2025, January 18). Why Chinese EVs are displacing Teslas. https://www.washingtonpost.com/climate-solutions/2025/01/19/byd-tesla-biggest-ev-manufacturer/

Selma Hyundai (n.d.). Hyundai Tucson Hybrid vs. Plug-In Hybrid: What’s the Difference. https://www.selmahyundai.com/blog/2025/january/30/hyundai-tucson-hybrid-vs-plug-in-hybrid-whats-the-difference.htm

Tabile, J. I. D. (2025, February 3). BYD PHL says sales jumped in 2024. BusinessWorld Online. https://www.bworldonline.com/corporate/2025/02/04/650783/byd-phl-says-sales-jumped-in-2024/

Toyota Philippines (n.d.). Corolla Cross. https://toyota.com.ph/corolla-cross

Toyota Malaysia (n.d.). New Corolla Cross Hybrid Electric. https://www.toyota.com.my/en/models/corolla-cross-hybrid-electric.html

Webb-site Database (n.d.). Financial reports: BYD Company Limited 比亞迪股份有限公司. https://webb-site.com/dbpub/docs.asp?p=18226

Xu, M., & Shirouzu, N. (2022, April 4). China’s BYD ends full combustion engine cars to focus on electric, plug-in hybrids. Reuters. https://www.reuters.com/business/autos-transportation/chinas-byd-ends-combustion-engine-cars-focus-electric-2022-04-03/

Zhou, C. (2023, November 7). How China’s BYD went from bargain battery maker to Tesla’s biggest rival. Nikkei Asia. https://asia.nikkei.com/Spotlight/The-Big-Story/How-China-s-BYD-went-from-bargain-battery-maker-to-Tesla-s-biggest-rival

Comments