September Update: Inflation, Monetary Policy, the Stock Market

- Andrei Dimaculangan, Jared Go, Antonio Panis, Ethan So, Elijah Soriano

- Oct 13, 2023

- 5 min read

Updated: Jul 20, 2025

Authored by: Andrei Dimaculangan, Jared Go, Antonio Panis, Ethan So, Elijah Soriano

Latest Economic Data:

Philippine Economic Data

Philippine Inflation for September accelerates to 6.1% YoY

BSP extends pause on the RRP at 6.25% but signals possibility of more hikes

Philippine Unemployment Rate for August decreased to 4.4%

US Economic Data

US inflation for August accelerates to 3.7% YoY

The Fed keeps the Federal Funds Rate at 5.25% but signals possibility of another rate hike

US 2nd quarter GDP revised lower to 2.1% from 2.4% on the back of lower consumption

US unemployment rate for September remained at 3.8%

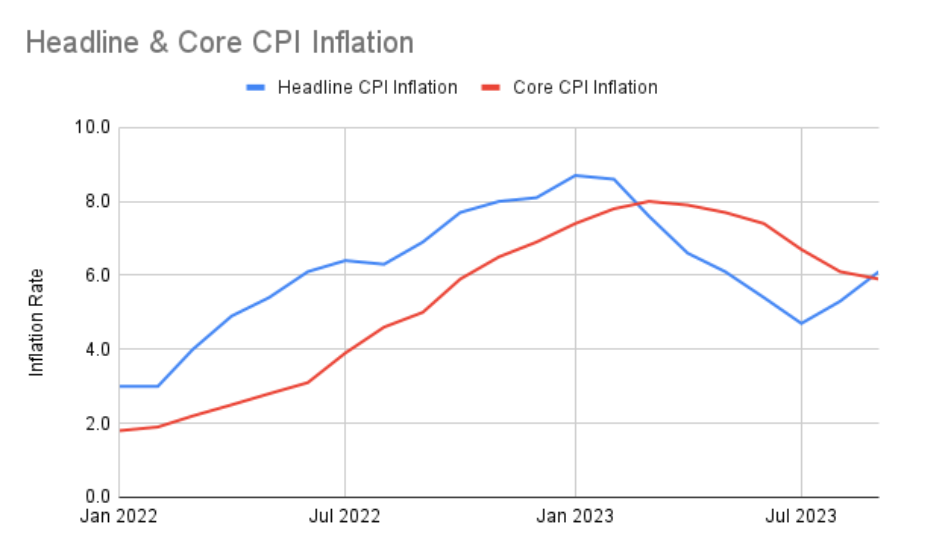

Data released by the PSA showed that the headline CPI inflation rate for September 2023 accelerated to 6.1%, higher than August 2023’s 5.3%.

However, when looking at inflation data, it is important to remember that the CPI is essentially a weighted average of price changes for various goods and services. Goods and services that are purchased more often by consumers tend to have a higher weight. Hence, volatile prices for heavily weighted categories (e.g. food) can affect the CPI drastically.

Core CPI inflation (which excludes select volatile food and energy prices) decelerated by 0.2 percentage points to 5.9%. This goes to show that while there was an uptick to headline CPI inflation, inflation for many categories actually trended downwards. Based on the data, there were two primary drivers that contributed to the uptick in the headline CPI inflation. These were food and non-alcoholic beverages, and transportation.

Food

Food and non-alcoholic beverages for September was shown to be at 9.7% which is a major uptick from August’s 8.1%. The primary contributor to this was rice at 17.9%.

The Philippines is a top importer of rice with approximately 3.9 million metric tons of rice imported each year. Supply shocks to the global rice sector can easily affect local market prices because the country relies on the global trade for rice. That being said, India, which is the largest rice exporter globally, banned non-basmati rice exports which in turn led to higher prices globally (United States Department of Agriculture, 2023). Additionally, another possible contributing factor is the market pricing in future supply-side effects of a widely anticipated El Niño. The Philippines has since turned to countries like Vietnam to cover for the supply shortages.

To address the surging prices of rice, the government imposed price caps on rice at a maximum price of 45 pesos per kilo in early September. While price ceilings may help curb the rising prices in the short run, it may also worsen the present shortage and hurt farmers via preventing them from maximizing profits. Moreover, the ever-increasing prices of rice and other food products disproportionately hurt the majority of the population who spend a significant portion of their income on food.

Transportation

Transportation inflation went from 0.2% in August, to 1.2% in September. With a volatile global oil market present once again, the Philippines is feeling the effects of higher oil prices in its transportation sector.

Public utility vehicles, trucking companies, and delivery services all rely heavily on fuel to operate. With fuel costs on the rise, transportation businesses face the challenge of increased expenses, potentially leading to an increase in fare price. As of the time of writing, the Department of Energy’s oil monitor showcased gasoline and kerosene prices by P2.00/liter and diesel by P2.50/liter, leading to a year-to-date increase of P17.50/liter for gasoline, P13.60/liter for diesel, and P9.94/liter for kerosene (Department of Energy, 2023).

Monetary Policy

On September 21, 2023, the Bangko Sentral ng Pilipinas (BSP) continued its interest rate pause by keeping the Reverse Repurchase Rate (RRP) at 6.25%.

Deputy Governor Francisco Dakila Jr. has stated that regardless of higher global oil prices, inflation in 2024 is expected to stay within the government’s target range of 2 to 4 percent. According to Dakila, even though oil prices have gone up globally, there is still some room before it has a significant impact on inflation. The BSP’s calculations show that inflation should remain in check as long as oil prices stay below $100 per barrel, and currently, they are hovering around $80 per barrel. Despite recent increases in oil prices, monetary authorities anticipate that monthly inflation rates will return to within-target levels by the end of the year.

It is imperative to note though that even if the BSP expects inflation to fall back to the target range within the year, rate hikes are not out of the question. BSP Governor Eli Remolona stated that upside risks to inflation are more likely (Arceo, 2023).

The Stock Market

The PSEi ended the month at the 6321.24 level (+2.36%), a positive reversal compared to the 6.31% decline in August. This reversal came after the PSEi dipped below the 6000 level due to the MSCI global index rebalancing. The PSEi is currently up 5.38% from its monthly low, nearing the 6400 level.

However, even with the reversal in the market, foreigners continued to be net foreign sellers with cumulative outflows of around 26.47B Php for the month of September. The continued exodus of foreign investors from the local stock market can be attributed to the rising global uncertainties and the aforementioned local inflation fears.

Although the PSEi is in the green for the month, YTD performance continues to be in the red with returns of (-3.57%). So, with rising global uncertainties coming from the US Fed along with domestic issues of high inflation and a hawkish BSP, the lack of positive catalysts may make this rally unsustainable in the coming months.

References

Arceo, Nina Miyka Pauline. (2023, September 23). Bangko Sentral chief: More rate hikes likely. https://www.manilatimes.net/2023/09/23/business/top-business/bangko-sentral-chief-more-rate-hikes-likely/1911366

Bangko Sentral ng Pilipinas. (2023, September 21). Monetary board maintains policy settings. Bangko Sentral ng Pilipinas. https://www.bsp.gov.ph/SitePages/MediaAndResearch/MediaDisp.aspx?ItemId=6856

Department of Agriculture. (2023a). Bantay presyo. https://www.da.gov.ph/wp-content/uploads/2023/01/Price-Monitoring-January-2-2023.pdf

Department of Agriculture. (2023b). Bantay presyo prices monitoring. https://www.da.gov.ph/wp-content/uploads/2023/09/Weeky-Average-Prices-September-4-8-2023.pdf

Department of Energy. (2022, October 13). Oil supply demand report. https://www.doe.gov.ph/sites/default/files/pdf/downstream_oil/Oil%20Supply%20and%20Demand%20Report%201H%202022.pdf

Department of Energy. (2023, September 28). Oil monitor as of 26 September 2023. https://www.doe.gov.ph/oil-monitor

Joann, V. (2023, August 9). 2024 inflation seen to stay within target amid oil price hikes. Philippine News Agency. https://www.pna.gov.ph/articles/1207524

Philippines Statistics Authority. (2023). Summary Inflation Report Consumer Price Index (2018=100): September 2023. https://psa.gov.ph/price-indices/cpi-ir/node/1684060859

Royandoyan, R. (2023, September 1). Philippines’ Marcos announces cap on rice prices. Nikkei Asia. https://asia.nikkei.com/Economy/Philippines-Marcos-announces-cap-on-rice-prices

U.S. Bureau of Economic Analysis (2023, September 28). Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), Second Quarter 2023 and Comprehensive Update. https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-second-quarter

U.S. Bureau of Labor Statistics (2022, November 10). Consumer Price Index Summary. www.bls.gov/news.release/cpi.nr0.htm.

U.S. Bureau of Labor Statistics (2023). Current Population Survey (CPS). www.bls.gov/cps/

United States Department of Agriculture Foreign Agricultural Service. (2022). Grain: World markets and trade. Foreign Agricultural Service. https://apps.fas.usda.gov/psdonline/circulars/grain.pdf

U.S. Federal Reserve (2023, September 20). Federal Reserve Issues FOMC Statement. Board of Governors of the Federal Reserve System. www.federalreserve.gov/newsevents/pressreleases/monetary20230920a.htm.

Comments